November 2023 Provisional Decision

March 2024 Definitive Decision

Date of document: 27/03/2024;

Date of effect: 03/04/2024 until 03/04/2029

The European Commission has imposed definitive anti-dumping duties on imports of certain polyethylene terephthalate (‘PET’) from China, defending EU companies and more than 1,500 jobs. The EU market of PET has a value of over €5.5 billion.

The Commission confirmed the provisional duties that were imposed on 27 November 2023, ranging from 6.6% to 24.2% depending on the exporting producer. These duties will be in place for a period of five years.

is rPET covered by the duties?

The document explicitly discusses the distinction between virgin polyethylene terephthalate (vPET) and recycled polyethylene terephthalate (rPET). The complainant, PET Europe, represented producers mainly involved in the production of vPET, but also provided estimated data for the rPET industry for the threat of injury assessment.

In the investigation and discussions within the document, there was a claim from an exporting producer (Jiangsu Ceville New Materials Technology Co., Ltd., referred to as ‘Ceville’) which requested the exclusion of rPET from the product under investigation. Ceville argued that rPET, being made from recycled materials, has different physical, technical, and chemical characteristics compared to vPET, and thus should not be included in the scope of the anti-dumping duties. However, the European Commission rejected this claim, noting that:

- Physical and Chemical Characteristics: Depending on the quality of the recycling process, rPET and vPET can have the same physical and technical characteristics and are interchangeable for the same end uses.

- Interchangeability: Both vPET and rPET are seen as interchangeable and compete with each other. Changes in the price of vPET affect the price of rPET and vice versa.

- Market Behavior: Some Chinese exporters had both vPET and rPET production capacities and were capable of exporting rPET to the EU during the investigation period.

Therefore, the European Commission decided that rPET was included within the scope of the anti-dumping duties as it competes directly with vPET and is affected by the same market dynamics. The duties cover all forms of PET regardless of whether they are virgin or recycled, reflecting the Commission’s approach to address all potentially dumped products that could harm the EU industry.

Are these duties added on the top of regural duties for PET/rPET imports?

Yes, anti-dumping duties are imposed in addition to any regular customs duties that apply to imports. Anti-dumping duties specifically aim to counteract the harmful effects caused by imports sold at below fair market value, i.e., “dumped” goods, which cause or threaten to cause material injury to the domestic industry of the importing country.

Here’s how they interact with regular duties:

- Regular Customs Duties: These are tariffs that are applied to imports under normal circumstances, based on trade agreements and a country’s standard tariff schedule. They are designed to protect domestic industries by making imported goods more expensive compared to locally produced items.

- Anti-Dumping Duties: These are additional tariffs imposed when a country determines through an investigation that certain goods are being dumped on its market at prices lower than their normal value in the exporting country. This is considered unfair competition and can hurt the domestic industry of the importing country.

In the case of the EU imposing provisional anti-dumping duties on imports of certain polyethylene terephthalate (PET) from China, these duties would be applied on top of any regular tariffs that might already apply to PET imports under the EU’s common customs tariff. The purpose is to bring the price of the imported goods up to what would be considered a fair market value, thereby leveling the playing field for EU producers.

What is the regular duty for PET/rPET now?

The general customs duty rate applied by the European Union for polyethylene terephthalate (PET) classified under CN code 3907 61 00, which includes most forms of PET such as granules used primarily in the production of fibers and plastic bottles, is 6.5%.

This duty rate is applied to imports from countries with which the EU does not have a free trade agreement that provides for a lower or zero tariff rate. It’s important to check the specific details of any trade agreements or special provisions that might apply to specific countries, as these can significantly alter the effective tariff rate.

How big is the scale of the problem and injury to the European Market?

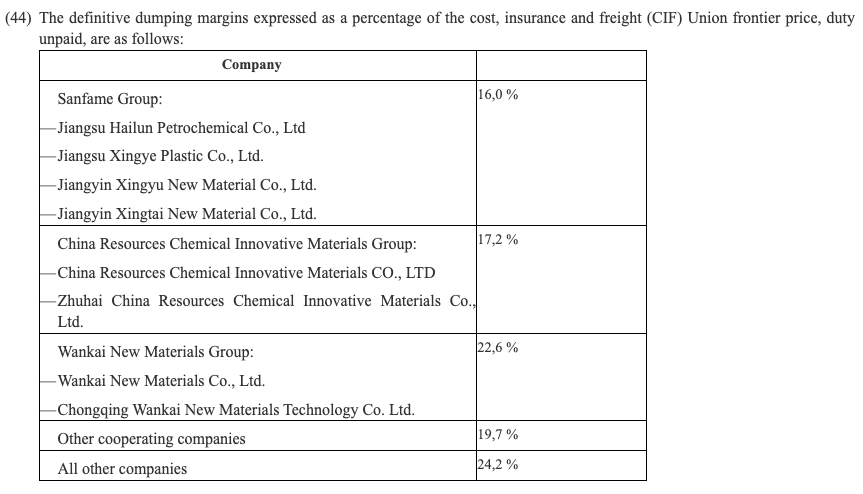

The definitive dumping margins expressed as a percentage of the cost, insurance and freight (CIF) Union frontier price, duty unpaid, are as follows:

In this scenario – all companies are covered by the 24.2% anti dumping customs, with exception of these listed above with lower rate applied.

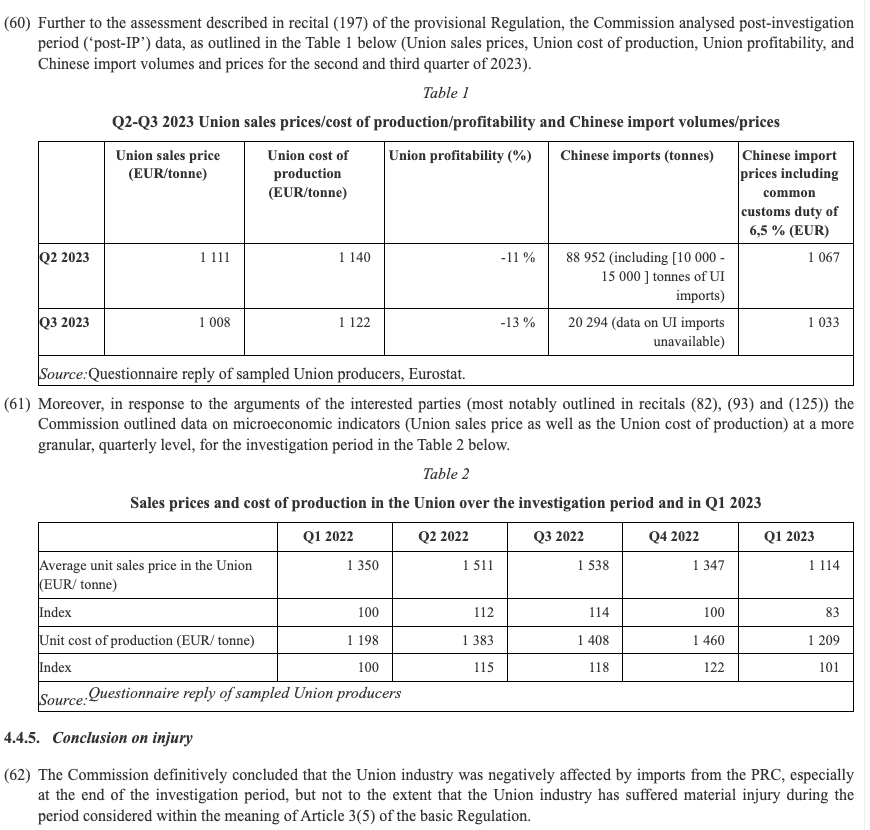

For Q2 and Q3 2023, the data revealed:

- Union sales prices decreased from EUR 1,111 per tonne to EUR 1,008 per tonne.

- The cost of production remained high, leading to negative profitability margins (from -11% to -13%).

- Chinese import volumes decreased significantly in Q3 2023 compared to Q2 2023, with prices slightly lower than Union sales prices after including the common customs duty of 6.5%.

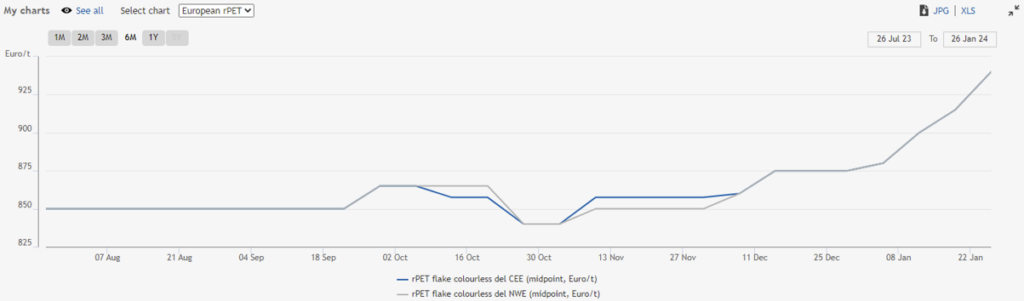

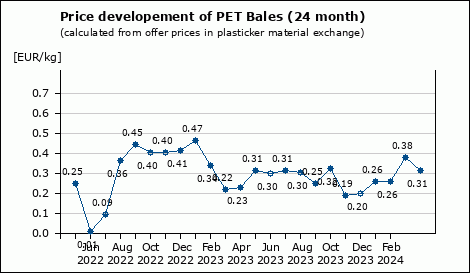

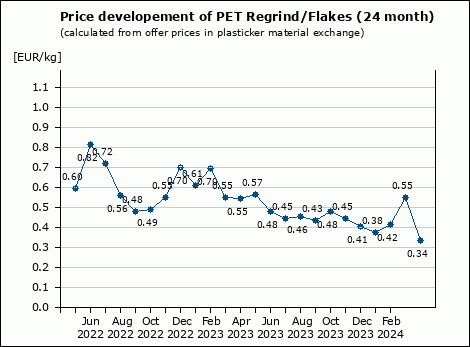

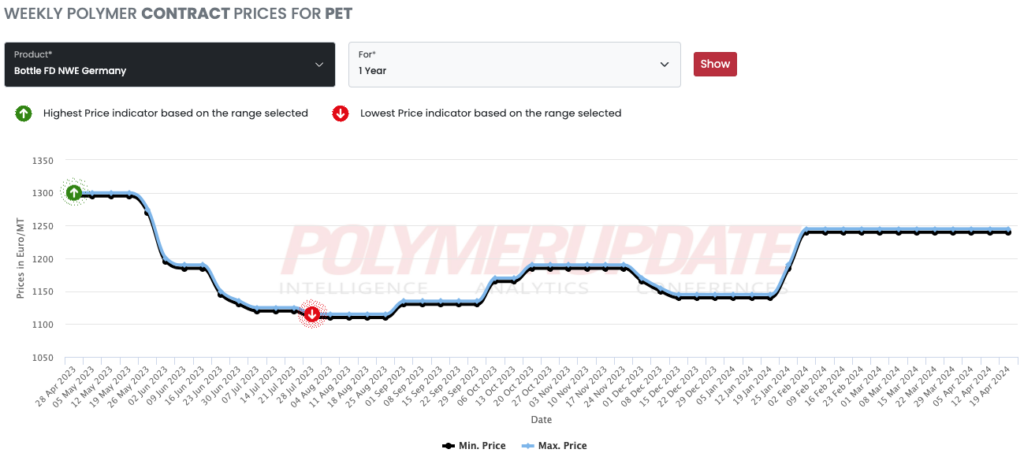

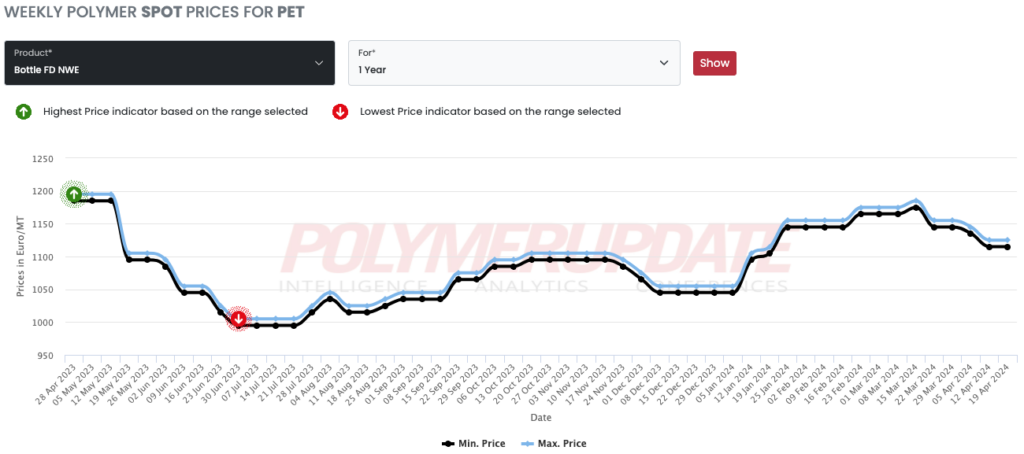

Price changes after 23 Nov 2023

Key Conclusions and price development:

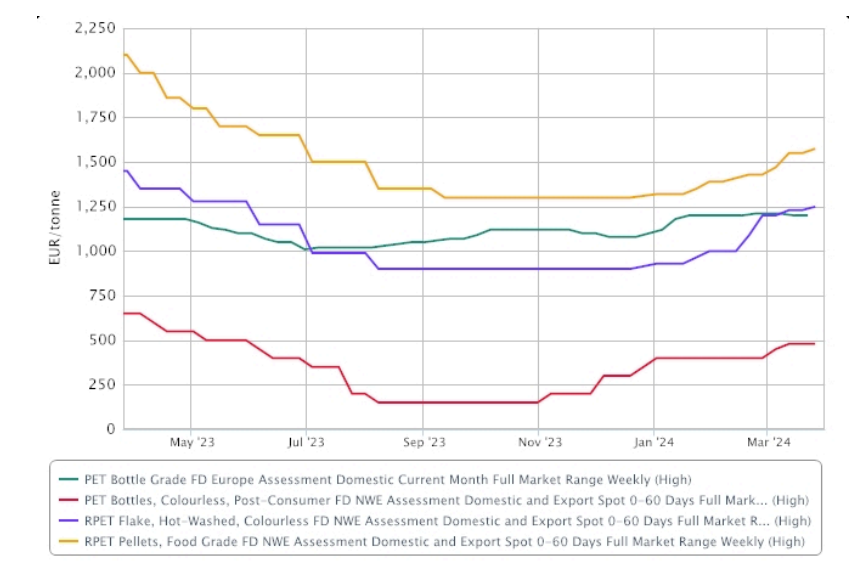

- Virgin PET went up as well as recycled PET in all forms since end of November/December

- Virgin PET bottle grade stabilized at 1250 Eur/mt for Long Term Contracts

- Spot PET price below the Long Term prices suggesting poor demand and oversupply of the market, yet at higher price base

- Poor demand in Q1 drove spot lower indicating poor economic conditions as expectations of rebound are postponed to Q2 2024

- Q2 2024 may cement a recycled PET pellet above 1500 eur/mt levels that is expected to be a new minimum in the EU until market balances at new levels in 2025

Leave a Reply